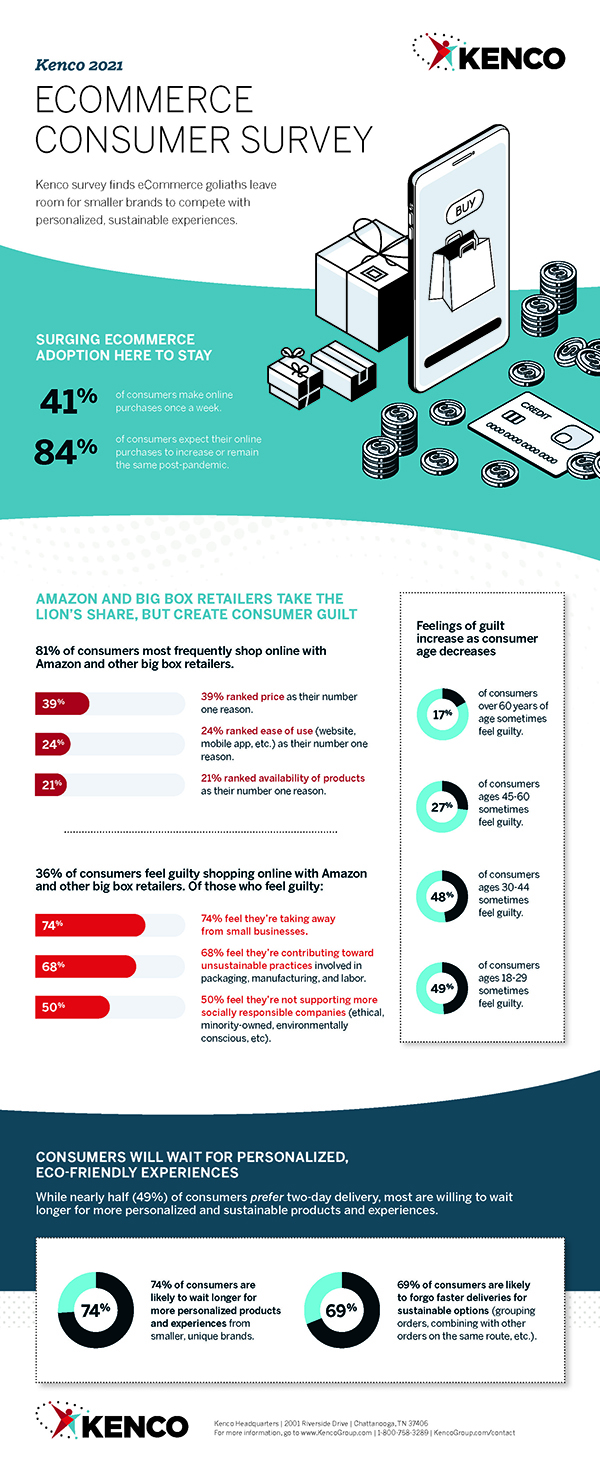

2021 ECommerce Consumer Survey

74% of consumers say they will wait longer for deliveries for personalized products and experiences from smaller, more unique brands.

Kenco Logistics, one of North America’s leading third-party logistics (3PL) providers, released its 2021 ECommerce Consumer Survey, which identifies key consumer trends and preferences across eCommerce shopping habits, sustainability, delivery, and more.

Conducted in May, the survey analyzed responses from nearly 1,300 U.S. consumers representing a wide variety of ages, incomes, and geographic regions. The results reveal a consumer base that values convenience and sustainability and will reward brands that can deliver a mix of both with their business. While 81% of consumers still shop online most frequently with Amazon and big box retailers for their low prices and convenience, today’s eCommerce consumers are conflicted in aligning their principles with their purchases, creating new market opportunities.

Surging eCommerce adoption is here to stay

The pandemic has proven its profound impact on consumer shopping habits, with relentless online order volumes continuing to challenge logistics networks at every level. And this impact shows no sign of fading.

• 41% of consumers make online purchases once a week

• Nearly 20% of consumers make online purchases multiple times a week

• 84% of consumers expect their online purchases to increase or remain the same post-pandemic.

“The pandemic drove record volumes of consumers to online shopping channels for the products and services they need during the pandemic,” said Dan Coll, vice president, eCommerce Fulfillment at Kenco. “This commitment to eCommerce is paving the way for brands to capitalize on digital sales growth and with the data showing most consumers expect to maintain and increase these new levels post-pandemic, eCommerce adoption is here to stay.”

Amazon and Big box retailers take eCommerce lion’s share, but create consumer guilt

The undeniably growing preference for eCommerce only confirms Amazon and big box stores’ continued domination of the market, with 81% of consumers choosing to most frequently shop online with these goliath retailers. When asked to rank their reasons for most frequently shopping online with either Amazon or big box retailers, price, user-friendly experiences, and availability came out on top.

• 39% ranked price as their number one reason

• 24% ranked ease of use (website, mobile app, etc.) as their number one reason

• 21% ranked availability of products as their number one reason

However, shopping online with Amazon or big box retailers is creating widespread consumer unease about the ethics involved in purchasing from a large chain store.

• 36% of consumers associate shopping online with Amazon or big box retailers with feelings of guilt.

Of the consumers who feel guilty:

• 74% feel they’re taking away from small businesses

• 68% feel they’re contributing toward unsustainable practices involved in packaging, manufacturing, and labor

• 50% feel they’re not supporting more socially responsible companies (ethical, minority-owned, environmentally conscious, etc.)

The data reveals that these feelings of guilt associated with making Amazon or big box purchases increase as consumer age decreases, showing trends towards environmentally and/or socially conscious shopping will only continue to gain momentum.

Consumers will wait for personalized, eco-friendly experiences

This consumer guilt is seemingly driving more lenient customer experience expectations, particularly for smaller, more unique organizations, according to the survey results. While nearly half (49%) of consumers prefer two-day delivery, most are willing to wait longer for deliveries for more personalized and sustainable products and experiences.

• 74% of consumers are either highly likely or likely to wait longer for deliveries for more personalized products and experiences from smaller, more unique brands

• 69% of consumers are either highly likely or likely to forgo faster delivery options for more sustainable options such as delaying deliveries by grouping orders or combining orders with others on the same route.

“The expectations levied toward Amazon and big box retailers are being eased for smaller, unique, and sustainable brands that more closely align with consumer values,” said David Hauptman, chief commercial officer at Kenco. “While consumers demand low prices and fast delivery times from national and global chains, they’re more forgiving when they know their dollars are contributing to sustainable or socially conscious practices. Small business owners can worry less about providing instant gratification if they’re offering quality, unique, and sustainable products.”

Although sustainability is top of mind for consumers, it’s often not commercially realized. The brands that can merge these seemingly at odd consumer needs – ethics and convenience – have an opportunity to capture the market. Companies are doing this by streamlining their supply chains at every touchpoint to reduce costs and delivery times wherever they can, freeing up capital that can be redirected towards sustainable business practices.

To view the survey infographic, visit info.kencogroup.com/2021-ecommerce-consumer-survey.