2021 Amazon Advertising Report

Jungle Scout, the leading all-in-one platform for Amazon sellers, released its 2021 Amazon Advertising Report, which analyzes data from more than 560,000 ad campaigns and 3,500 brands, agencies, and third-party sellers advertising on Amazon to examine Amazon's booming advertising business. The report reveals that a significant majority of brands opt to advertise their products on Amazon, and one in three are increasing their ad investments in 2021.

Key insights from the 2021 Amazon Advertising Report include:

Shifts to ecommerce are fueling Amazon's growth.

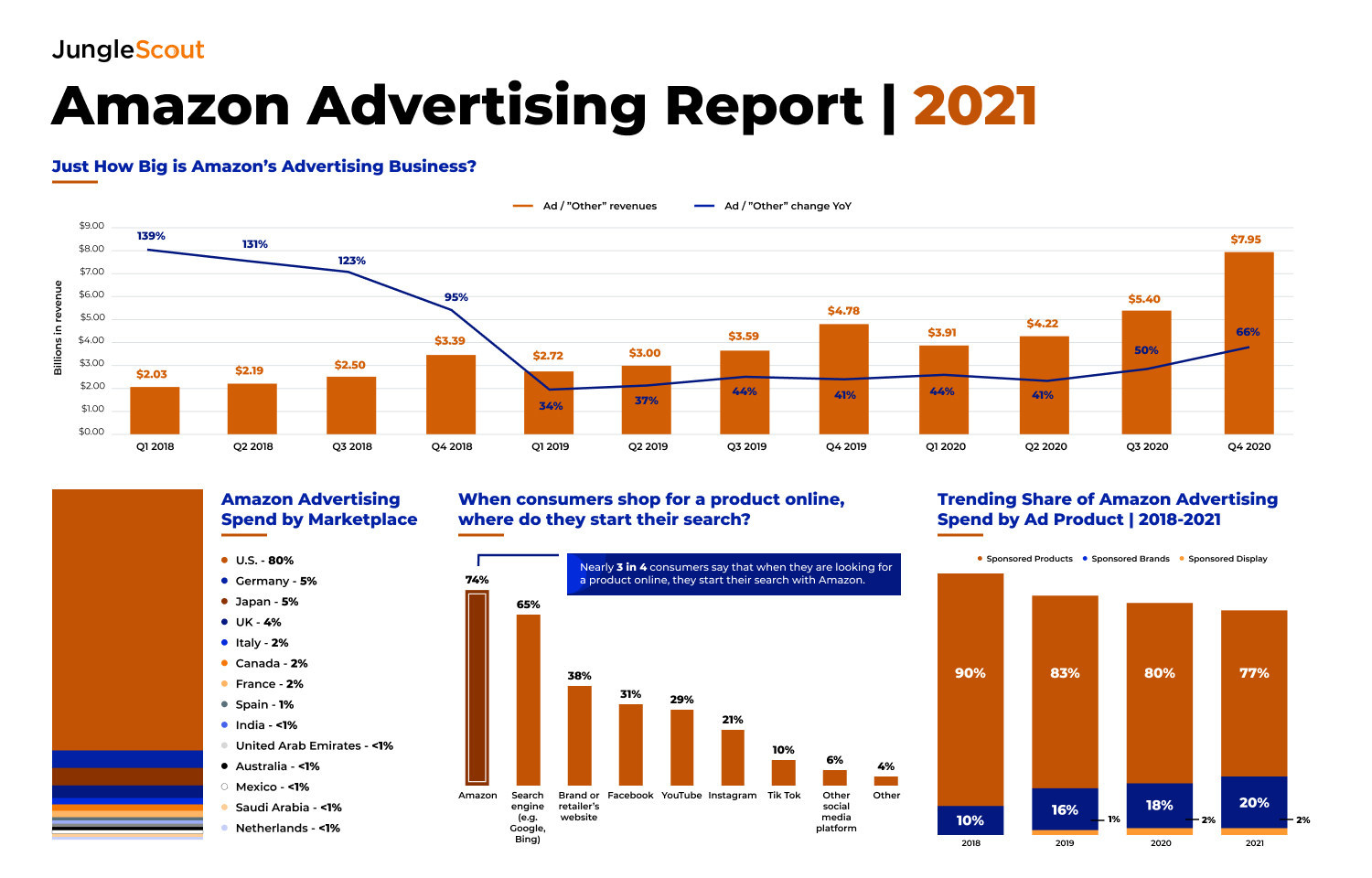

• Amazon has become the starting point for the majority of shopper journeys; 74% of consumers begin their product searches on the "Everything Store."• Amazon's ad revenue growth is accelerating. In Q4 2020, Amazon's ad revenue reached $7.95 billion, up 66% over the previous year.

• 56% of U.S. consumers say that if they were only able to buy products from a single store, it would be Amazon

• 37% of U.S. consumers say that while overall spending may be lower than normal, their online spending has been increasing.

Brands, agencies, and third-party sellers are pumping investment into Amazon Advertising.

• Targeting shoppers with ads on Amazon allows sellers to reach potential customers when they are ready to buy, and it's a strategy most sellers employ already; 75% of sellers use at least one type of Amazon pay-per-click (PPC) advertising.• Sellers are investing even more in advertising in 2021; 34% of Amazon sellers plan to spend more on strategic advertising than in past years.

• Ad spend is shifting from sponsored product ads to sponsored display and brand ads — which see an increased return on investment.

"Advertising has become an imperative aspect of running a business on Amazon," said Connor Folley, Vice President of Jungle Scout and co-founder of Amazon advertising analytics platform Downstream. "Amazon makes it much easier to attribute a company's advertising spend to actual conversions — easier than other large advertisers, such as Facebook or Google. Additionally, brands on Amazon can take advantage of the rising popularity of Amazon as a product search engine in order to get more eyes on their products."

About the Report

Findings in the Amazon Advertising Report are based on Jungle Scout's ecommerce data collected between March 2018 and February 2021 across 14 global marketplaces. It references 3,500 distinct products/brands and 560,000 unique Amazon advertising campaigns across all key ad media.