Reimagining stores for retail’s next normal

At some point, retail stores will reopen—but unless apparel and specialty retailers redefine the role of the store and revamp store operations, they will be ill prepared for the post-COVID-19 future.

As the COVID-19 pandemic erupted, hundreds of thousands of stores across the United States shut their doors, unsure as to when they would reopen. Retail workers have been furloughed or laid off en masse, causing widespread economic pain and deepening the devastation of an unprecedented public-health crisis.

At some point, stores will reopen and people will return to work, as evidenced in countries like China where the pandemic has passed its peak. The timing is uncertain and will differ across US markets, but what’s certain is that stores can’t simply pick up where they left off. COVID-19 has changed consumer behavior, perhaps permanently, and retail stores will need to take these new behaviors into account.

To maximize their potential when they emerge from the crisis, retailers must factor in the realities of the post-coronavirus world. In this article, we share a perspective on the trends that will affect US apparel and specialty retail stores postcrisis and the strategic imperatives that will enable them to thrive in the “next normal.”

How the crisis has changed consumer behavior

Consumers have altered their shopping and buying behavior during the pandemic. For one, loss of income and declining consumer confidence have driven decreases in discretionary spending. In an April 6–12 survey of US consumers, 67 percent of respondents said they expect to spend less on apparel in the near future than they typically do.

A potentially longer-lasting behavioral change is the accelerated adoption of e-commerce. Even before the pandemic, consumers were increasingly browsing and buying online. In the recovery period, retailers could see spikes in online shopping even in categories that in the past were primarily store-based (such as makeup). It’s also possible that e-commerce will attract consumer segments that previously preferred to shop offline, such as baby boomers and Gen Zers. Post-pandemic, apparel executives expect up to a 13 percent increase in online penetration, according to a survey we conducted in early April. Indeed, retailers in Asia—where precrisis online penetration was much higher than in the United States—are expecting a “sticky” increase in online penetration of three to six percentage points as they reopen stores.

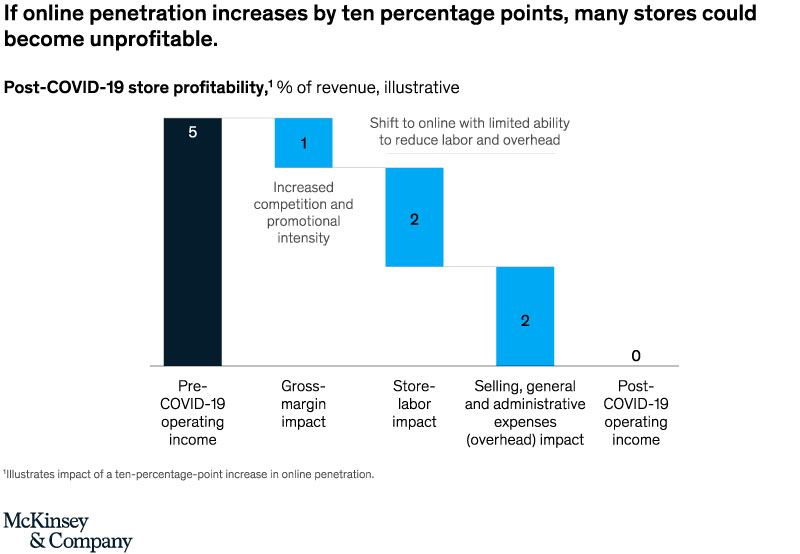

These trends will shape the industry’s next normal and could have profound implications on a retailer’s P&L. Store sales could plummet, fiercer competition and increased operational complexity due to workforce disruptions could contribute to margin compression, and the migration of sales from stores to e-commerce (typically a lower-margin channel for retailers) could further hurt profitability. To illustrate: if online penetration increases by ten percentage points and gross margin falls by one percentage point, driven by increased pricing pressure, retailers could expect store profitability to decline by up to five percentage points (exhibit). A hit to profitability of this magnitude could push a significant number of brick-and-mortar stores into loss-making territory.

In short, the coronavirus crisis has escalated the case for change for retail stores into a proverbial “burning platform.” We urge retailers to prepare for the next normal by taking decisive action now. Forward-thinking retailers will redefine the role of their stores, streamline store operations, and reevaluate their store networks.

Strategic imperatives to prepare for the next normal

To survive and thrive in the post-coronavirus world, apparel and specialty stores must fundamentally change how they operate on both sides of the P&L. We see three strategic imperatives for simultaneously improving the top line and the bottom line:

Radically accelerate in-store omnichannel integration

Unless stores offer consumers a compelling value proposition, store traffic—which was already thinning in pre-coronavirus times—will slow to a trickle. Consumers are now accustomed to staying home for weeks at a time and buying a wide range of products online. In the future, they won’t visit stores unless retailers give them good reason to. Retailers must therefore gain a deep and up-to-date understanding of customer preferences, envision a new role for their stores in light of these preferences, and execute surgical changes to store formats and in-store customer experience.

During the crisis, physical distancing and stay-at-home mandates compelled retailers large and small to launch omnichannel initiatives, with even mom-and-pop stores offering contactless curbside pickup. In-store omnichannel integration will become “table stakes” in the next normal. In our survey of US apparel executives, 76 percent said they plan to improve omnichannel integration in stores.

To jump-start this integration, retailers could consider the following actions:

• Redefine the role of the store. More than ever, stores need to offer unique customer experiences instead of simply serving as transactional venues. To better cater to changing customer preferences in the next normal, stores should seek to deliver a superior product-discovery experience and provide access to exclusive merchandise (for example, through “in store only” and “in store first” product launches).

• Offer omnichannel fulfillment basics. To meet rising customer demand for contactless fulfillment options, retailers should introduce curbside pickup and “buy online, pick up in store” (BOPIS) features and continuously improve the execution of these services.

• Build an omnichannel staff. Retailers should invest in training and equipping store associates to engage with customers online, so that store staff can guide customers at the start of the product-discovery journey and interact with them postpurchase. Retailers with a truly omnichannel mindset could also reward store associates for influencing online sales in local zip codes.

• Enable personalization of in-store touchpoints. If store associates have access to customer data generated both offline and online (for example, data on loyalty and purchase behavior across channels), they can tailor their customer interactions accordingly. Even customers that start and end their journeys online can then receive personalized attention in stores.

Reimagine store operations to reflect the new reality

When stores reopen, retailers can’t expect a seamless return to pre-coronavirus store-operations norms. They will need to reset stores’ cost structures and prepare their workforce for the next normal.

1. Reset store cost structure

Retailers may find that they need to deliver 20 to 30 percent improvement in store productivity to compensate for the channel shift away from physical stores. To achieve this, they will need to relentlessly simplify store operations and rebalance the allocation of store costs to support the increasing volume of in-store omnichannel activities.

Shift complexity upstream. To support stores with reduced postcrisis staffing levels, store-operations leaders should collaborate with the merchandising function to reset store-replenishment frequency and minimum stock levels to reflect postcrisis sales and traffic in stores. In addition, distribution and sourcing teams can potentially find ways to shift certain tasks (such as price tagging and labeling) away from stores and to distribution centers or, where possible, vendor locations.

Rapidly digitize and automate non-value-added work. Retailers should digitize and automate in-store activities, where possible, to free up associates for higher-value work. This includes automating labor scheduling, expanding the use of self-checkout and mobile checkout, and providing remote-management tools for store and field managers.

• Improve omnichannel touchpoints. Retailers might consider, among other options, dedicating staffing for ship from store, redesigning BOPIS processes, improving inventory management, and working with the supply-chain function to reduce the end-to-end cost of fulfilling orders.

• Introduce contactless self-serve features for omnichannel transactions. Over the past few weeks, consumers have increased their adoption of contactless services in retail sectors such as grocery. There’s a good chance they will continue to demand similar experiences in other brick-and-mortar settings even after the pandemic. Retailers should consider providing contactless self-serve options for online order pickups, price checks, and returns management. (We’ve found, for example, that 60 to 70 percent of the typical retailer’s returns process can be digitized.)

When stores reopen, retailers can’t expect a seamless return to pre-coronavirus norms. They will need to reset stores’ cost structures and prepare their workforce for the next normal.

2. Prepare the workforce for the next normal

The pandemic has caused dramatic disruption in the retail frontline workforce. In our survey of apparel and specialty-retail executives, 75 percent indicated that their companies have either furloughed or laid off store associates since the crisis began. During the recovery, retailers should shape their future workforce to support the evolving role of the store and should improve workforce flexibility to prepare for potential recurring virus-related disruptions.

• Retain pre-COVID-19 talent. Given the scale of furloughs and layoffs (some retailers have furloughed all store associates), retailers risk losing some of their high-performing associates for good. One way to minimize this risk would be to stay in touch with furloughed store associates and provide regular updates on store reopening plans and timelines. Retailers can use a variety of digital tools to conduct online huddles and one-on-one check-ins or to issue periodic newsletters. They might also consider redeploying store associates to fill omnichannel roles as they wait for stores to reopen.

• Improve training and onboarding. Digital learning tools can help facilitate training outside the traditional store or classroom settings. Microtrainings—which consist of a series of short, focused learning modules often delivered through rich media formats—can serve as an effective training approach to accelerate onboarding and improve retention. Store processes, including sales effectiveness, visual merchandising, and price and promotion management, could be ideal candidates for microtraining initiatives.

• When rebuilding store teams, rethink workforce composition. The lasting effects of the crisis call for a reevaluation of store-associate roles, expected skills, minimum staffing levels, and other aspects of team composition. Retailers may need to upskill store associates to achieve the required digital fluency and cross-train employees to optimize the number of distinctive store roles.

• Improve workforce flexibility. Retailers should increase the agility of their workforce models to manage any potential future virus-related disruptions and to better respond to changes in store traffic. This could include enabling employee mobility across stores and incorporating “gig” workers into the store workforce.

Optimize the store network based on omnichannel performance

Retailers had been rightsizing their store network even before the COVID-19 crisis—but the pandemic has heightened the urgency for them to have a clear vision of their future-state network. In our survey, 53 percent of respondents said they expect to close underperforming stores in the aftermath of COVID-19.

Retailers should incorporate their future-state vision into their store reopening plans. To do this right, they must make network decisions based on an omnichannel perspective of long-term store performance. The traditional way of looking only at “four-wall economics” is outdated because it doesn’t account for the role that a store might play in generating e-commerce sales. To better understand a store’s true economic value, a retailer should modify the store P&L to include its e-commerce halo—for example, by ensuring that the store “gets credit” for e-commerce sales in the local zip code. A forward-looking omnichannel view of each store’s performance should incorporate postcrisis traffic projections and the retailer’s envisioned role for the store.

A retailer can then develop a future-state vision for its store network. Outcomes from this exercise might include accelerating store-closure plans, particularly for stores with a pending exit opportunity; choosing not to reopen stores with expected low productivity; accelerating rent negotiations and footprint rationalization for stores that are essential but underperforming; and adding network nodes (either stores or distribution centers) in areas where the retailer lacks omnichannel coverage.

Apparel and specialty retailers should be prepared to open their stores as soon as regulatory restrictions are lifted. Of course, employee and customer safety will continue to be the top priority. At the same time, retailers can lay the foundation to thrive in the next normal—and once again become a source of livelihood for millions—by proactively planning the comeback using a P&L lens, paying close attention to both sales and profitability.

By Praveen Adhi, Andrew Davis, Jai Jayakumar, and Sarah Touse of Mckinsey